Can AI Help Make Prescriptions Safer in South Africa’s Busy Clinics?

By Henry Adams, Country Manager, InterSystems South Africa

Across South Africa, nurses and doctors in public clinics make hundreds of important decisions every day, often under enormous pressure. They’re short on time, juggling long queues, and sometimes working with incomplete information. In those conditions, even the most experienced professionals can make mistakes. It’s human.

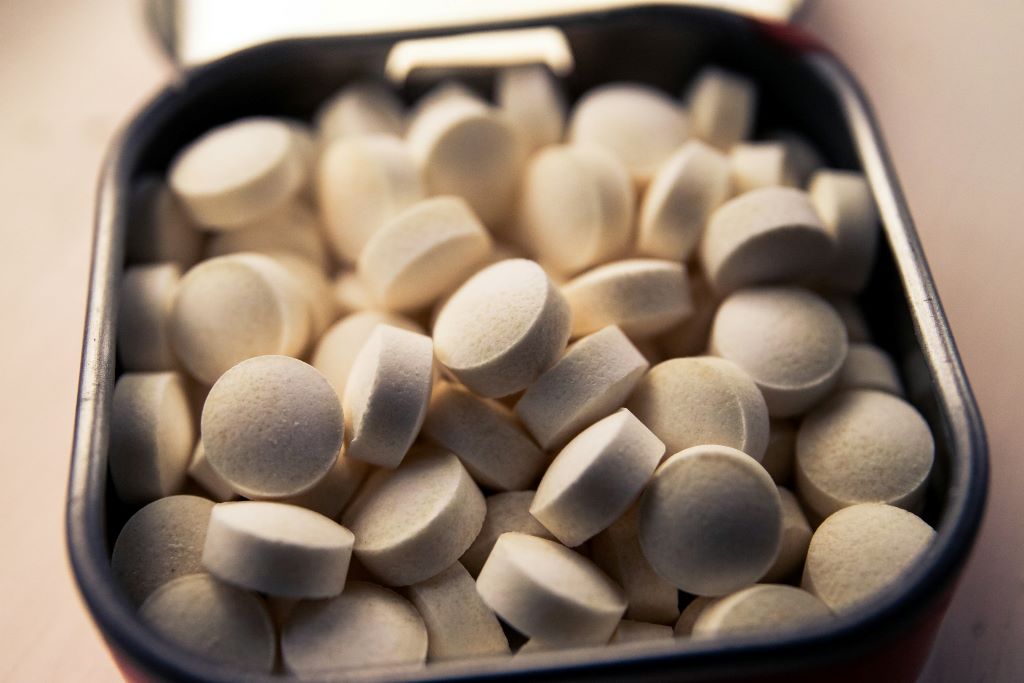

The truth is, our healthcare system is stretched thin, and people can only do so much. That’s why I see real potential for AI to step in as a kind of virtual pharmacist. Not to replace anyone, but to back them up by checking prescriptions, catching errors, and helping ensure patients get the right treatment quickly and safely.

From data to decision support

I’m often asked how AI can make a real difference in healthcare right now. One area where it can have an immediate impact is in prescriptions. AI-assisted systems help doctors and nurses make safer, faster decisions by analysing medical data in real time. They can check a patient’s history, allergies, and possible drug interactions in seconds, flagging risks before they become problems.

Of course, because we’re dealing with sensitive medical information, trust and data quality are crucial. These systems only work when they’re built on accurate, connected data that healthcare professionals can rely on.

That’s where the latest health technology partnerships come in. By linking proven data platforms with smart AI tools, we’re already seeing real improvements overseas. In Europe, for example, these systems are helping clinicians catch potential drug errors early and prescribe with greater confidence.

There’s no reason South Africa can’t benefit in the same way. With clinics under pressure and resources stretched, technology that connects clean, reliable data with practical AI support could help reduce errors, save time, and make care safer for everyone.

Addressing local challenges

Medication errors can happen anywhere, but in South Africa the stakes are often higher. Our public clinics are exceptionally busy, staff are stretched, and doctors and nurses are doing their best under tough conditions. When you’re working under that kind of pressure, even a small mistake in a prescription can have serious consequences for a patient.

This is where AI can really help. Imagine a system that double-checks every prescription in real time, flagging possible drug interactions, incorrect dosages, or missing information before the medicine ever reaches the patient. It’s like having an extra set of expert eyes that never get tired. Instead of slowing things down, it speeds them up and gives clinicians peace of mind knowing they’re making the safest call for each patient.

For that to work, though, the data behind the system must be reliable and up to date. As South Africa moves toward a unified digital health record, the ability for these systems to connect to existing patient information becomes crucial. When healthcare professionals can trust the data they see on screen, AI becomes a genuine partner in care, helping them work faster, smarter, and safer.

Building confidence in AI

For AI to really work in healthcare, it must be clear and trustworthy. Doctors and nurses need to know why the system is recommending a specific drug or warning about a potential issue. If it can’t explain itself, people won’t use it, and rightly so.

That’s why transparency matters. The best AI tools don’t make decisions behind closed doors; they show their reasoning and help clinicians understand what’s happening in the background. When that’s combined with reliable, well-managed data, you start to build real confidence in the system.

It’s that trust, knowing the technology supports rather than replaces clinical judgment, that will make AI-assisted prescriptions part of everyday care, not just an interesting experiment.

A collaborative path forward

Technology on its own won’t fix South Africa’s healthcare challenges, but it can make a big difference in helping people do their jobs better. AI-assisted prescriptions are a good example of how smart tools can take some of the pressure off clinicians, reduce paperwork, and help patients get safer, faster care.

What excites me most is how practical this can be. Picture a nurse in a rural clinic who needs to prescribe medication but doesn’t have easy access to a specialist. With AI support, she can get accurate, instant guidance and know her patient is getting the right treatment. Or think about a busy hospital pharmacy, where an AI system automatically checks for drug interactions across hundreds of files in seconds, preventing errors before they happen.

This isn’t some far-off idea. The technology already exists and is being used successfully elsewhere. The goal now is to make sure it’s used in a way that supports our healthcare professionals, not replaces them. They are, and always will be, at the centre of care. If we get this right, AI can become a real partner in healthcare.